Silence is making waves in the world of climate tech investment. This innovative angel-style VC firm has successfully raised $35 million and is focused on making numerous small investments in climate startups, guiding them through the tech startup playbook.

The driving force behind Silence is Borja Moreno de los Rios, the solo general partner of Silence’s original fund. Prior to establishing Silence, Borja served as a venture partner at FJ Labs and founded Merlin, a U.S.-based hourly jobs marketplace.

Borja’s personal connection to nature and the environment from a young age has inspired his transition into climate investment. He and his team of tech experts have delved deep into the world of climate knowledge, aiming to drive impactful change in the sector.

Since its inception in June 2022, Silence has invested in a diverse range of 22 companies, adhering to their unique investment strategy. Silence opts not to lead rounds or take board seats, maintaining a neutral stance akin to that of an angel investor with a larger investment capacity.

The average investment ticket size for Silence ranges from $100k to $700k, with an emphasis on pre-seed to Series A investments. Notably, the firm has strategically avoided competing with top-tier VCs, securing partnerships with renowned firms like Point Nine, FJ Labs, and FifthWall.

Among Silence’s portfolio companies are ventures focused on virtual power plants, energy management systems, and circularity-driven marketplaces. Borja highlighted the success story of Cardino, a used EV marketplace that rapidly achieved significant growth post-investment.

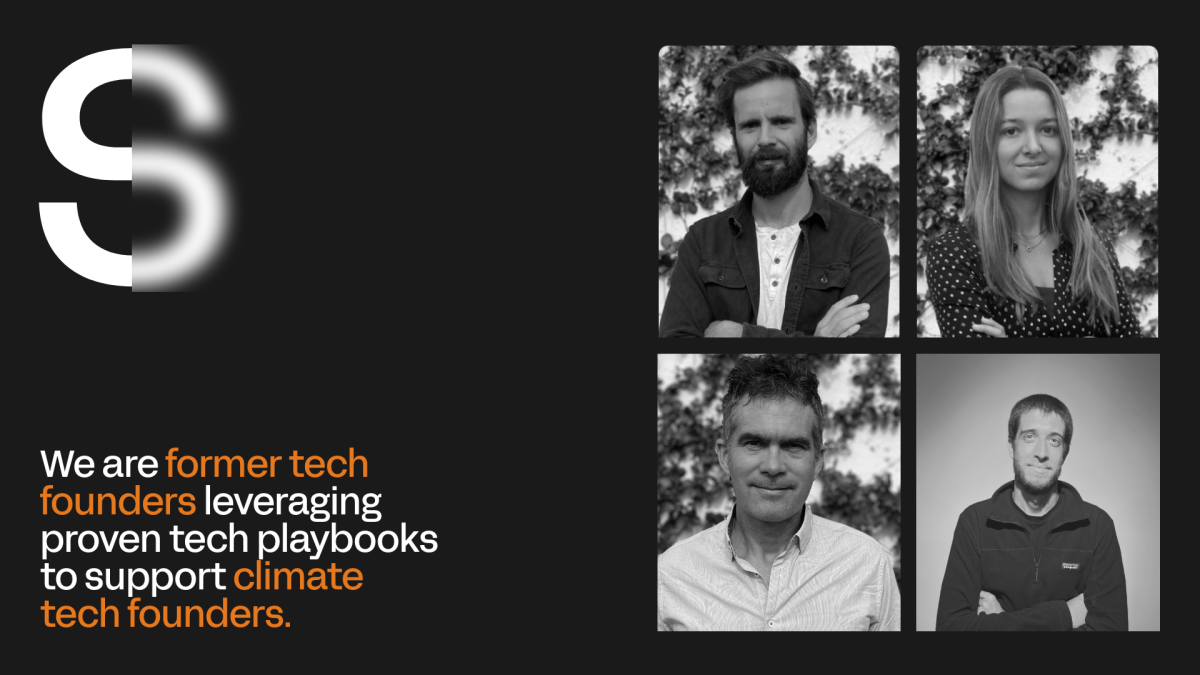

Expanding its team, Silence welcomed professionals like Sara Ramos Colmenarejo and Guilherme Penna from Hummingbird and Global Founders Capital, respectively. Brendan Hayes serves as the fund’s CFO and COO.

With a broad group of limited partners, including top VC firms and successful founders, Silence maintains an enthusiastic and focused approach to climate investment. Borja’s commitment to prioritizing SaaS and marketplaces over deep tech investments reflects the firm’s strategic vision for creating tangible climate impact.