NVIDIA, a leading graphics card, chip, and tech company, is facing challenges as its stock price plunges due to a combination of industry market downturn and a delay in the release of its upcoming Blackwell chip. The company saw a significant drop of around 13% in its stock price on the opening of trading following reports of potential delays in its shipments by up to three months.

This delay, disclosed on Friday, coincided with a broader decline in tech industry prices. Over the past 24 hours, major tech companies like NVIDIA, Google, Amazon, Microsoft, Apple, and Meta (Facebook) have all witnessed a decline of 10% or more in their stock prices. While some companies, like Apple, have shown signs of stabilization, others are still struggling to recover.

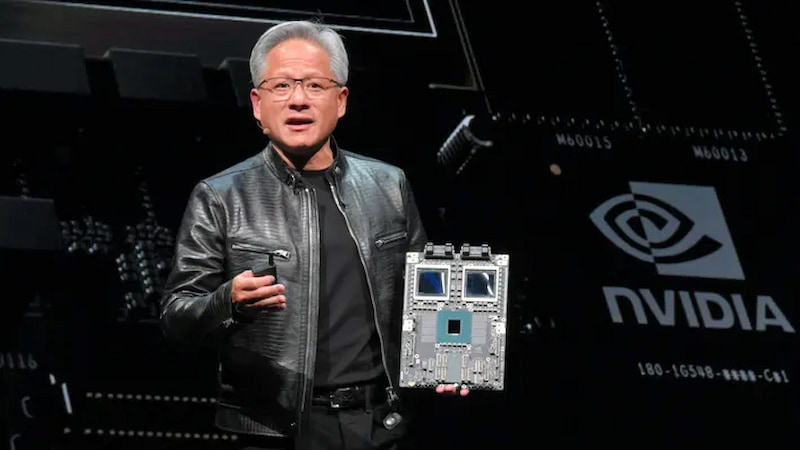

Image Credit: Nvidia

The decline in tech prices was triggered by a steep drop in Japan’s stock market, resulting in the largest one-day decrease in share prices since 1987. This event had a ripple effect on Western markets, leading to lower-than-expected market openings and further exacerbating the tech industry’s slump.

The setback faced by NVIDIA is compounded by the pre-existing delay in its Blackwell chip, which serves as the backbone for its new data center architecture and the latest line of GeForce RTX Mobile GPU cards.

Image Credit: Nvidia

The Blackwell chip is heavily marketed for applications in AI, which adds to the worries surrounding the sustainability of AI technology contributing to the recent tech stock decline.

The repercussions of these developments on the gaming industry remain uncertain, but historically, tech downturns have had a trickle-down effect on video game studios. Gamers may also experience the impact financially when hardware shortages occur due to increased demand from commercial clients.

Amid a looming global tech crisis, the gaming sector, a significant subset of the tech market, could potentially face challenges in the aftermath of the overall market turmoil.