A recent study focusing on the founders of “Unicorns” (companies valued at over a billion dollars) has revealed that most of them have backgrounds as “underdogs”, often graduate from the top 10 universities, see an increasing number of female founders, and lack a clear monopoly among Venture Capitalists at the Seed stage of funding.

The study, known as the “Unicorn Founder DNA Report” conducted by Defiance Capital, examined 845 unicorns and 2,018 unicorn founders to identify the common characteristics of these successful individuals.

Key findings of the study include:

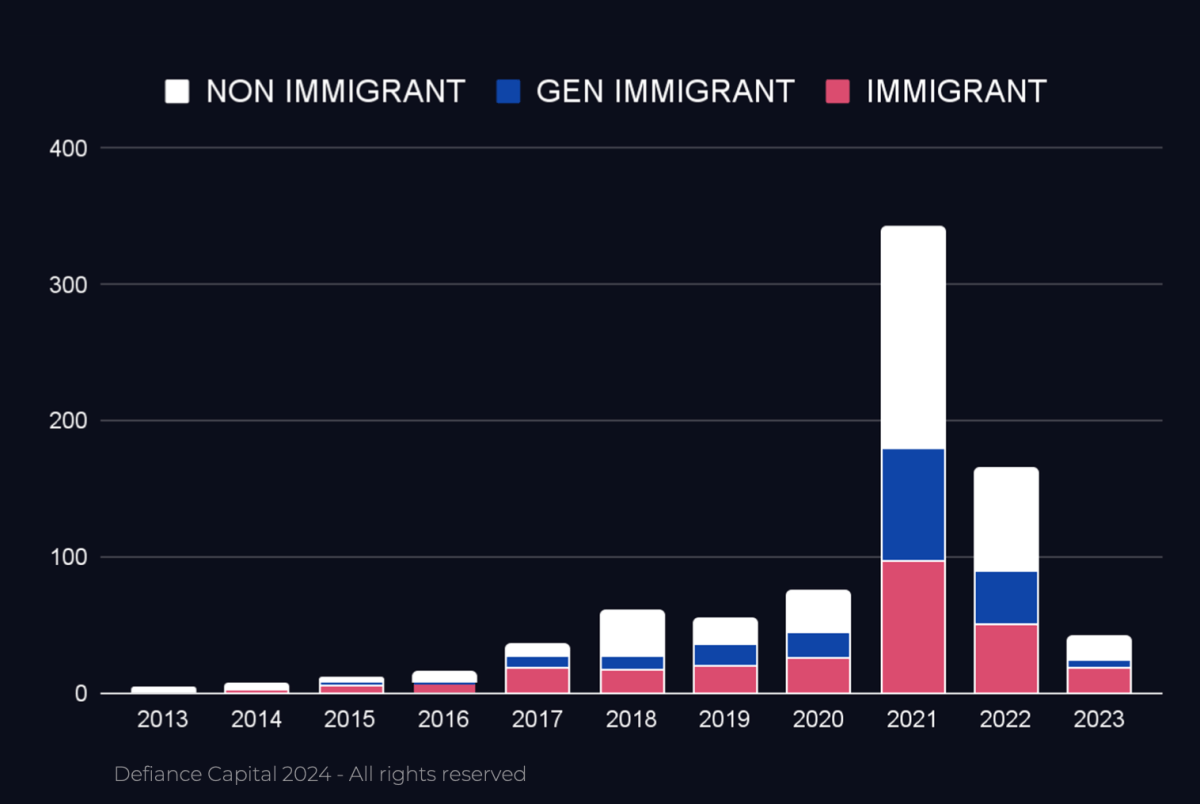

• 70% of unicorns have “underdog founders” (immigrants, women, people of color).

• The number of unicorns with female founders has increased to 17% in 2023.

• 53% of unicorn founders hold degrees from the top 10 global universities.

• 49% of unicorn CEOs have STEM degrees, with 64% of female founding CEOs also having STEM backgrounds.

• Apart from SV Angel (6.4%) and YC (10%), no other VC fund has invested in more than 2.8% of unicorns at the Seed stage, indicating a fragmented market for potential unicorn investments.

The study also highlighted the racial composition of unicorn founders, with a significant presence of Asian and non-white founders. It was noted that 38% of unicorns had at least one founder who was not white, with only 3% having a black founder.

Furthermore, only 21% of immigrant and female founders received funding from the top ten VCs, with teams led by female founders typically being two years younger than all-male teams at the time of founding their unicorns.

Serial founders were found to have a higher likelihood of success in building unicorns, while solo founders were less common. The study also emphasized the fragmented nature of the market for Seed funds, with only 28% of unicorn founders raising capital from a top VC seed fund.

Additional insights from the study included the identification of three key factors in the “DNA” of a unicorn founder:

1. No “plan B”

2. “A chip on the shoulder”

3. Unlimited self-belief

The study highlighted the growth mindset and personal backgrounds of unicorn founders, with many citing experiences of facing limitations and unfair treatment, particularly within disadvantaged communities.

Notably, a higher percentage of 1st and 2nd generation immigrant CEOs possessed STEM degrees compared to local CEOs, suggesting a brain drain from emerging economies to developed countries.

Finally, the study underlined the importance of diverse founder backgrounds and the potential for new funds to target underrepresented founders for investment opportunities.

Defiance Capital founder Christian Dorffer shared insights from the study, emphasizing the need for VCs and family offices to adapt their strategies based on the findings to maximize returns and support emerging managers.

He also teased an upcoming podcast featuring unicorn founders, showcasing their determination and inspiring stories of overcoming challenges in the startup ecosystem.