In 2023, the gaming market experienced a downturn following its peak during the pandemic, further challenged by economic turmoil and slumps. Within the global mobile games market, two major marketing trends emerged: an increase in advertisers and growth in the number and proportion of new creatives.

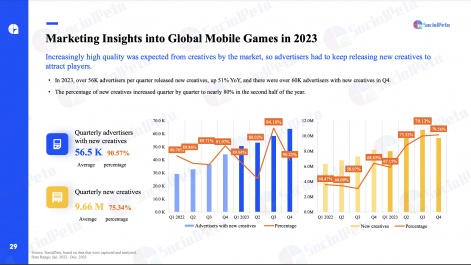

As the demand for higher-quality creatives rose in 2023, game advertisers had to develop unique and captivating ad creatives to attract users. The Asia-Pacific region continued to be the most competitive in global mobile games marketing, with Southeast Asia experiencing intense competition in media buying. Blue Ocean Markets also began to emerge. Due to privacy policies and other factors, Android surpassed iOS in marketing efforts and is expected to continue to do so in 2024.

In response, SocialPeta has released the “2023 Global Mobile Games Marketing Trends White Paper“, offering a detailed analysis of the core dynamics of the global mobile gaming market in 2023. The whitepaper provides comprehensive insights into the gaming market, including top charts of mobile games in advertising, revenue, and downloads, analysis of global hit games, and observations of popular markets. This invaluable resource equips game developers, marketers, and mobile marketing peers with the latest and most comprehensive insights into global mobile game marketing.

Key Highlights of 2023 Global Mobile Games Marketing Trends

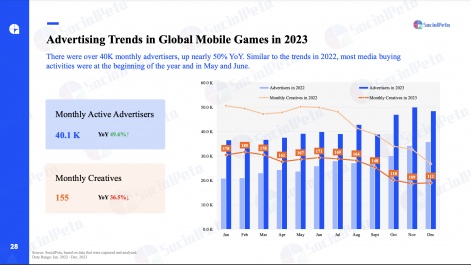

Over 40,000 monthly mobile game advertisers were observed in 2023, marking a nearly 50% year-over-year increase. The majority of media buying activities occurred at the start of the year, and in May and June, followed by a decline towards the end of the year.

With respect to different regions, Southeast Asia emerged as the most competitive market in 2023:

- The average monthly number of advertisers in Southeast Asia nearly reached 20,000, surpassing Oceania to become the third-largest region.

- Southeast Asia led all regions in the average monthly volume of mobile game creatives, with each advertiser averaging 135 creative pieces per month. Additionally, the average monthly volume of materials in China’s Hong Kong, Macau, and Taiwan also exceeded 130.

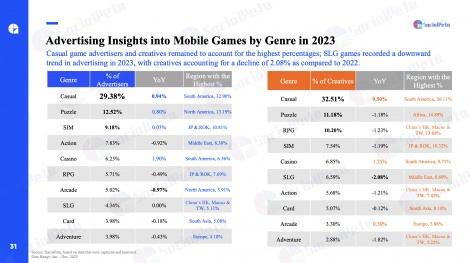

Casual games continued to have the highest proportion of advertisers and creatives, with the proportion of casual creatives increasing by 9.5% compared to the previous year. On the other hand, the proportion of advertisers in SLG games remained stable, but their share decreased by over 2% in 2023.

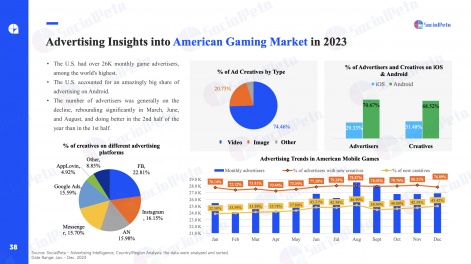

In the United States, monthly mobile game advertisers exceeded 26,000 in 2023, surpassing other countries and regions. Among these advertisers, Android held a dominant position in the U.S. mobile game market, with over 70% of advertisers and creatives exceeding 68%.

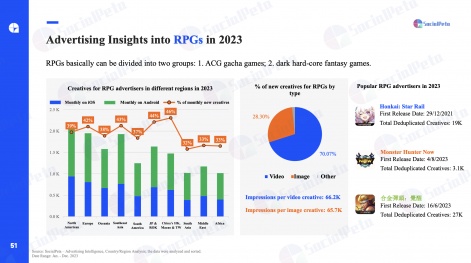

Within popular game genres, RPGs stood out as the most prominent genre in 2023. The average monthly number of RPG advertisers was approximately 1,400, with new RPG creatives accounting for over 35% each month. China’s Hong Kong, Macau, and Taiwan saw the fastest release of new RPG creatives, with an average monthly proportion exceeding 46%.

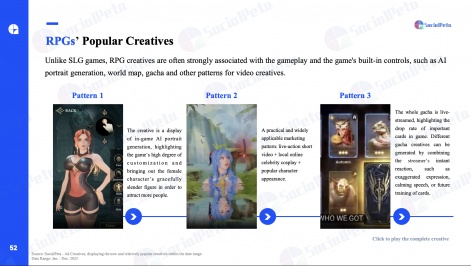

Many RPG game advertisers focused on showcasing the gameplay and the game’s built-in controls through their creatives, including AI portrait generation, world maps, and gacha patterns for video creatives.

Evolution of Mini-Game Advertising

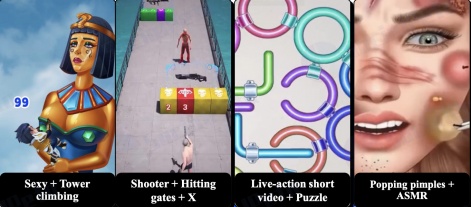

In 2023, mini-game advertising witnessed substantial growth and overall popularization within the gaming industry. With the rise of ACG mini-games, game companies began embracing mini-game advertising, evolving from “main game + mini-game” to “mini-game +”. Creatives moved from poorly incorporated mini-games to well-designed three-stage formulas, such as “eye-catching start + gameplay display + deliberate failure.”

The whitepaper also reviewed the marketing performance of Honkai: Star Rail, Arena Breakout, MONOPOLY GO!, and Block Blast! in 2023. For a detailed report, please download the full report.

The release of this whitepaper has received strong support from industry partners, including Singular, Udonis, AnyMind Group, Appvertiser, Persona.ly, AppSamurai, Tenjin, Thiet ke Game, Gamee Studio, Mobidictum, UGC NINJA, AdQuantum, and App Masters. The full report, over 70 pages in length, offers the latest data and forward-looking insights to empower gaming professionals in the global market.