The National Payments Corporation of India (NPCI) is engaging with fintech startups to address the market dominance of PhonePe and Google Pay in the UPI ecosystem.

NPCI executives are meeting with companies like CRED, Flipkart, Fampay, and Amazon to discuss initiatives to boost UPI transactions on their apps.

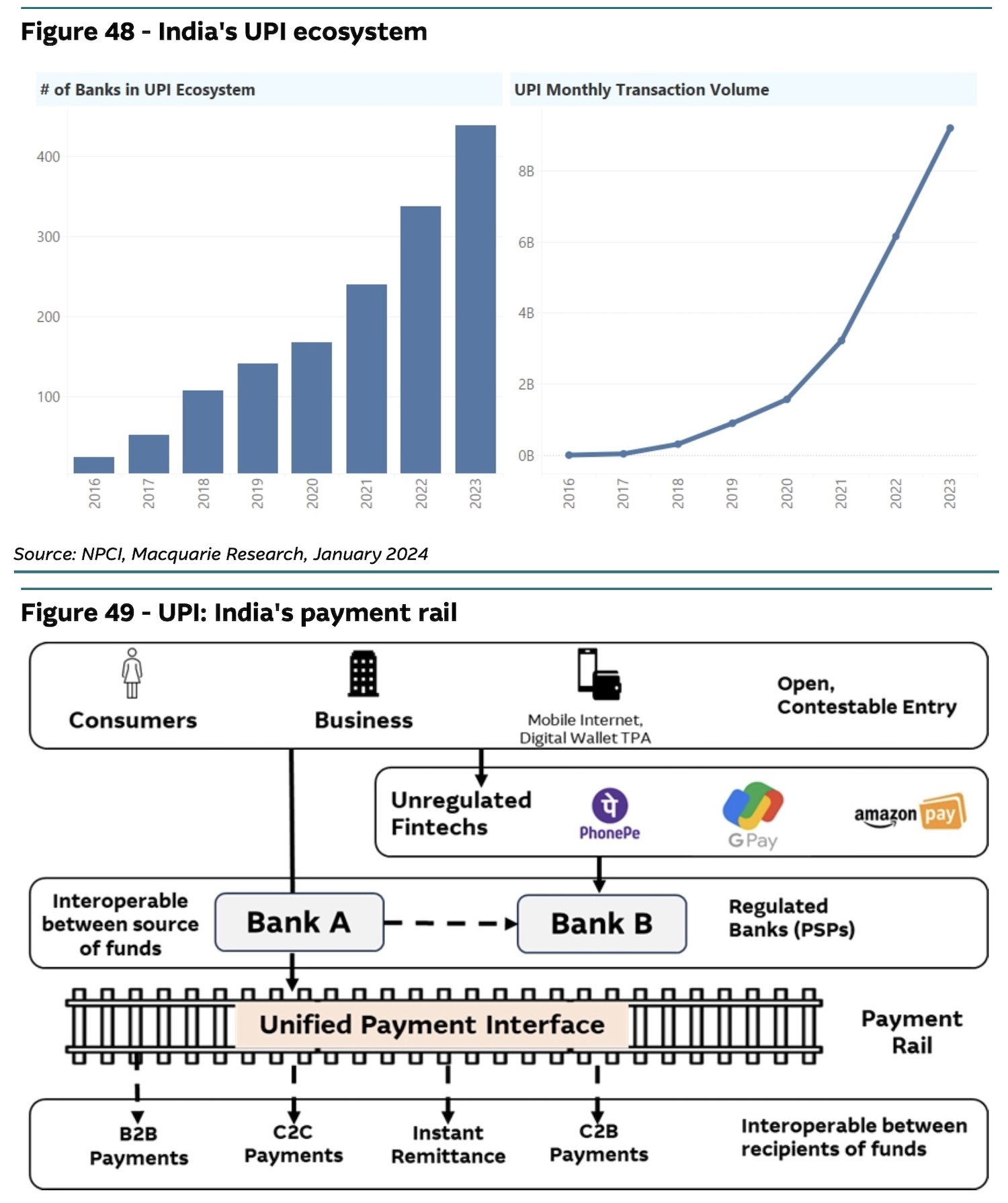

UPI, developed by Indian banks, is the most popular online transaction method in India, processing over 10 billion transactions monthly.

Efforts are being made to address concerns about Google Pay and PhonePe holding nearly 86% of UPI transactions, with Paytm’s market share declining.

An overview of India’s UPI ecosystem. (Image: Macquarie)

The RBI has expressed concerns about the duopoly in the payments space, prompting discussions on supporting domestic fintech players as alternatives.

NPCI aims to limit market share of UPI players to 30%, with a deadline extended to December 2024, facing challenges in enforcement.

The RBI may introduce incentives to create a more competitive field for emerging UPI players.

NPCI is encouraging fintech companies to offer incentives to users for making UPI transactions.