Quantum Tech Partners has recently published its 2024 Gaming Industry Report, delving into the realms of M&A activity, funding trends, and layoffs within the industry. The prevalence of job cuts has been on the rise over the past year, persisting from 2023 into 2024 and impacting major players like Sony and Gameloft.

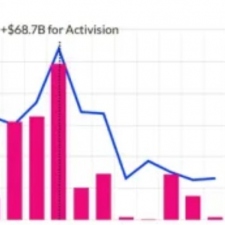

The highlights of Quantum’s report include a notable decline in capital market withdrawals and a slowdown in merger activity. In 2023, the total spending on mergers and acquisitions hit a low of $11.8 billion, marking the lowest annual figure since 2019. This decrease was largely influenced by the extraordinary acquisitions in 2022, particularly Take-Two’s $12 billion purchase of Zynga and Microsoft’s monumental $69 billion acquisition of Activision Blizzard.

However, even after excluding these record-breaking deals, the overall M&A deal value in 2023 was still down by about 70%, as stated by Alina Soltys, co-founder of Quantum Tech Partners, in an interview with GamesBeat.

Despite Microsoft’s acquisition of Activision Blizzard being finalized in October, Quantum’s report focuses on the timing of deal agreements.

A Dip in the Numbers

Excluding the Microsoft deal, the first quarter of 2022 witnessed the highest M&A spending in the past five years, nearing $25 billion. The subsequent quarters of 2022 saw a significant decrease in deal values, with around $5 billion in Q2, $7.5 billion in Q3, and less than $1 billion in Q4.

Comparatively, 2021 maintained a more consistent level of M&A activity, with approximately $15 billion in three quarters and a low of around $3 billion in Q2.

The decline in 2023 was evident not only in the total value of acquisitions but also in the number of deals. Year-on-year, the number of M&A deals fell by 43%, while the transaction value dropped by 69%.

The decline in deal counts began in Q4 of 2022, with a drastic reduction from nearly 130 deals in Q1 to just over 40 by year-end. In contrast, 2023 reached its peak of almost 60 deals in Q1, followed by around 50 deals per quarter throughout the rest of the year.

The challenges of 2023 were apparent as early as Q1, with a combined total of only $1.2 billion in investments and M&A activities.