A surge of smaller startups is entering the payments market while awaiting the IPO of the $65 billion tech giant Stripe. One of the latest players is Danish company Flatpay, which specializes in payment solutions for small and medium-sized physical merchants like shops, restaurants, and salons. Recently, it secured €45 million ($47 million) in funding led by Dawn Capital.

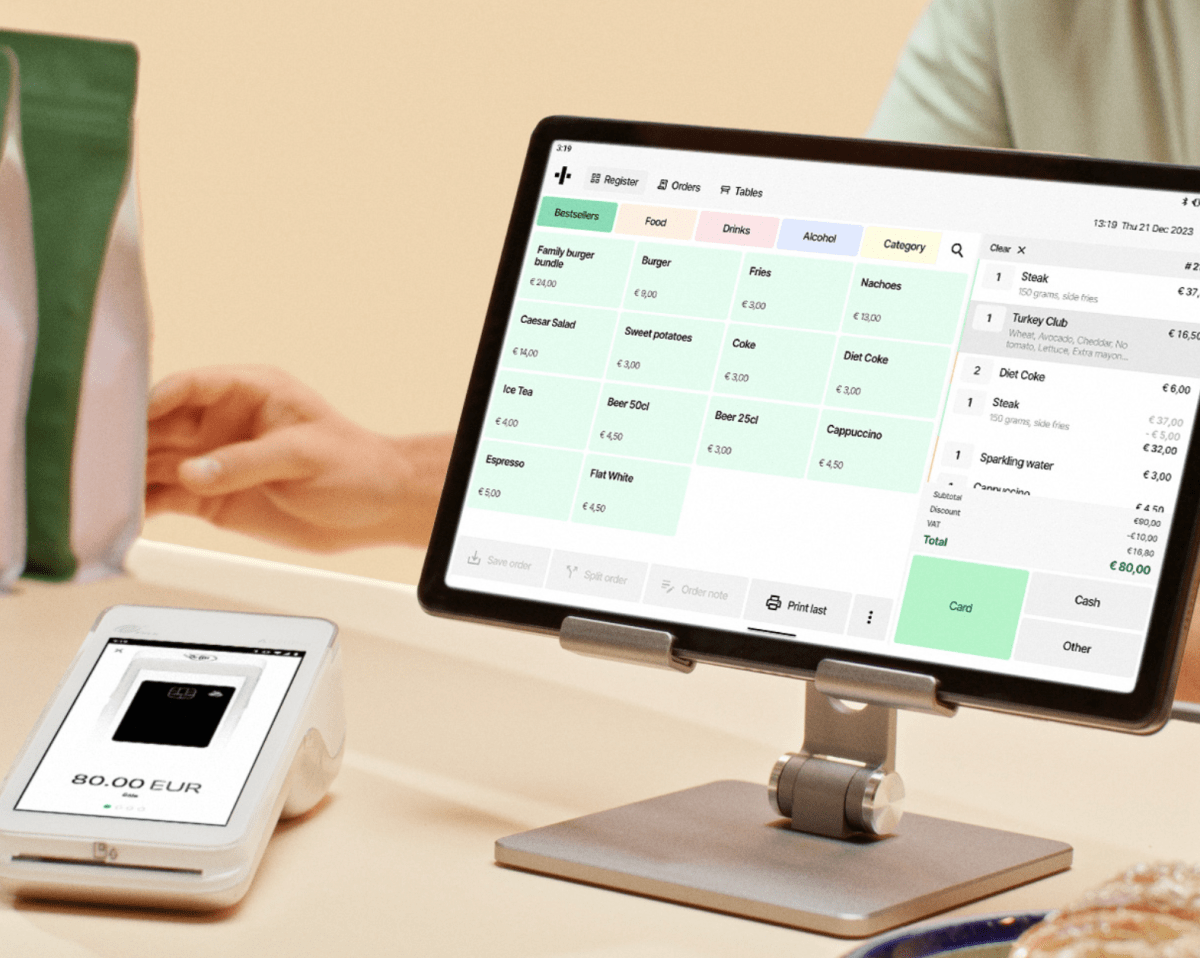

Flatpay, valued at over $100 million post the Series B funding, aims to expand its presence in new European markets and diversify its product offerings beyond the current point-of-sale and card terminals. While AI may play a role in enhancing features, it is not the central focus, according to Flatpay’s CEO, Sander Janca-Jensen.

The $45 million Series B funding signifies significant growth potential for Flatpay in the European market. Despite serving just 7,000 customers across Denmark, Finland, and Germany, the company continues to witness 15% monthly growth in both revenues and customer base.

With over 24 million SMBs in Europe and more than 17 million point-of-sale terminals, the payments industry is highly competitive with big players like Stripe, Adyen, and PayPal. Flatpay’s unique selling point lies in offering simple solutions tailored for merchants seeking technology convenience without complexities.

Flatpay’s strategy revolves around customer segmentation, technology-driven simplified fee structures, and a personalized sales approach. The company operates with customer turnover exceeding €100,000 annually, offering basic transaction fees without minimum charges while emphasizing in-person sales visits for customer acquisitions.

By prioritizing field sales to ensure product understanding and effective communication, Flatpay differentiates itself in the increasingly crowded payments market. Half of its 200 employees are dedicated to sales, ensuring localized expertise for personalized customer engagement.

Investors like Dawn Capital and Seed Capital see potential in Flatpay’s innovative approach to payments, underscoring the scalability of its customer-focused sales model. Despite doubts about long-term scalability, the company’s robust growth and tailored sales strategy continue to attract investor confidence in its future success.

Emphasizing the importance of localized sales teams and personalized customer interactions, Flatpay’s unique sales approach stands out in the competitive payments landscape, promising a significant opportunity for expansion and market dominance.