As Reddit’s public debut looms, another lesser-known company, Astera Labs, is set to go public, posing a significant test for investors’ interest in tech IPOs.

Astera recently announced in a public filing that its IPO will be larger than originally planned, with more shares to be sold at a higher price. The company expects to raise over $500 million from its debut, marking a notable increase from previous projections, indicating growing investor confidence.

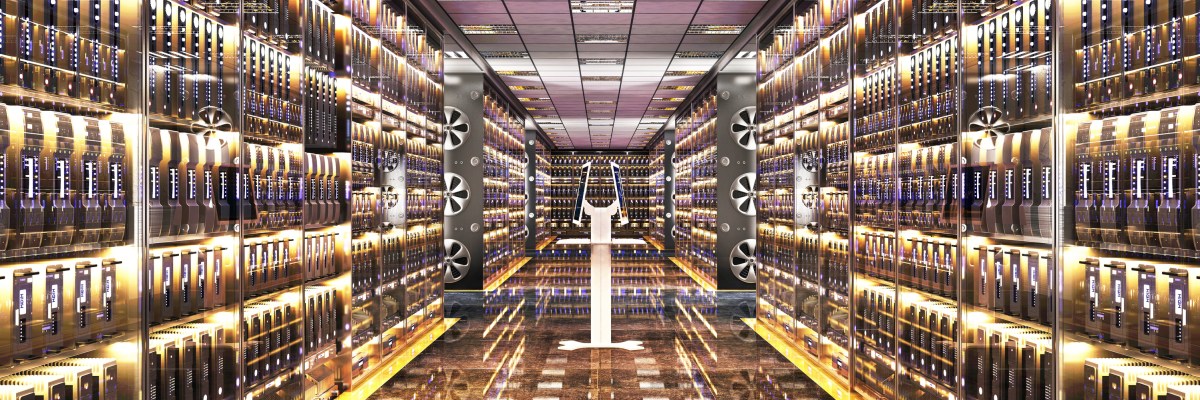

While Reddit’s IPO garners attention for its mix of social media and AI, Astera Labs focuses on AI hardware, specifically connectivity hardware for cloud computing data centers. The company’s revenue surged by 45% in 2023, highlighting its potential in the AI space.

With a strong emphasis on AI in its SEC filings, Astera aims to position itself as a key player in the artificial intelligence sector. The company’s growth and profitability have attracted investor interest, with notable customers like Amazon showing support.

Companies Can Simultaneously Grow and Generate Profits

Unlike many startups that prioritize growth over profitability, Astera Labs has demonstrated a balance between expansion and financial success. While initially posting losses, the company’s recent financial performance has shown significant improvement, with a notable shift towards profitability.

Despite some concerns about customer concentration and market volatility, Astera’s recent financial results have been positive, leading to a successful IPO valuation of approximately $5.2 billion.

Astera’s IPO could pave the way for other AI-focused companies to enter the public market, highlighting the increasing interest in technology offerings and the potential for continued growth in the sector.