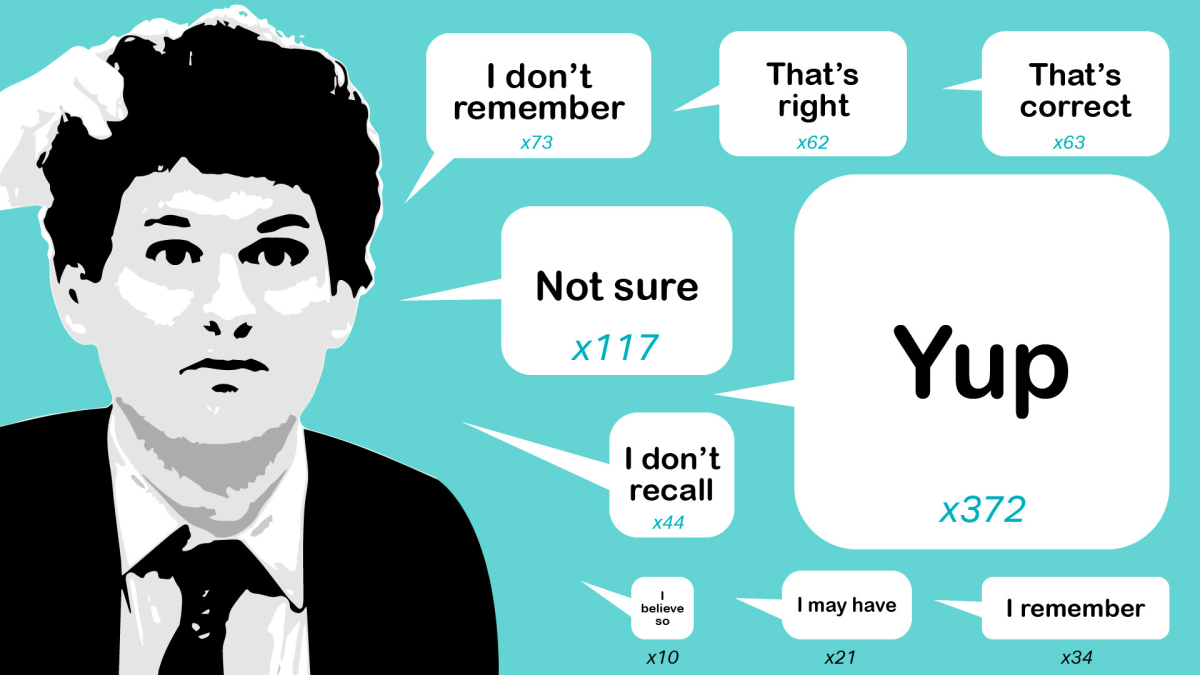

Former FTX CEO Sam Bankman-Fried has been sentenced to 25 years in prison for wire fraud and money laundering.

Bankman-Fried’s scam involved diverting customer deposits from FTX to his other company, Alameda Research, for purposes like supporting political campaigns and investing in crypto startups.

After leaks and investigative reporting, a run on FTX led to the unraveling of the scheme and the loss of billions in customer funds.

While some believe that crypto is entering a more practical phase, with developers focusing on building useful applications, the reality is that blockchain projects have largely been driven by speculation.

Despite various applications being built on blockchains like Ethereum and Solana, there has yet to be a clear success story or economically viable purpose beyond speculation.

As the crypto industry faces increased scrutiny and regulation, the true value of blockchain-based startups remains uncertain.

Bitcoin continues to serve as an alternative to traditional currencies in unstable economies, offering a means of preserving wealth and facilitating international transactions.

Unlike newer coins that rely on faith and trust, Bitcoin’s value is inherently tied to the energy consumed in its creation and validation, making it a more tangible asset.

In the absence of a breakthrough in energy production, Bitcoin’s value is likely to remain tied to real-world energy consumption.