VNV Global, a Swedish investment firm specializing in startups in mobility, health, and marketplaces, has reduced the value of its stake in Wasoko, an African B2B e-commerce startup, by 48% according to its 2023 annual report.

The annual report reveals that VNV set Wasoko’s fair value at approximately $260 million as of December 2023, coinciding with Wasoko’s announcement of its merger with MaxAB in Egypt. VNV’s valuation of its 4.2% stake amounts to $10.9 million.

This markdown isn’t the first for Wasoko by VNV. In Q4 2022, Wasoko was valued at $501 million following a $125 million Series B investment. VNV Global invested $20 million in that round. The current valuation is based on a valuation model using trading multiples of public peers.

Wasoko expressed pride in VNV’s continued support, especially amidst the merger with MaxAB. VNV Global plans to retain its stake post-merger, expecting significant long-term value growth from the combined entity.

The report also anticipates positive outcomes from the MaxAB merger, as VNV Global emphasizes its long-term investment strategy. Wasoko, founded by Daniel Yu in 2014, operates as one of Africa’s largest B2B grocery marketplaces with a strong presence in multiple African markets.

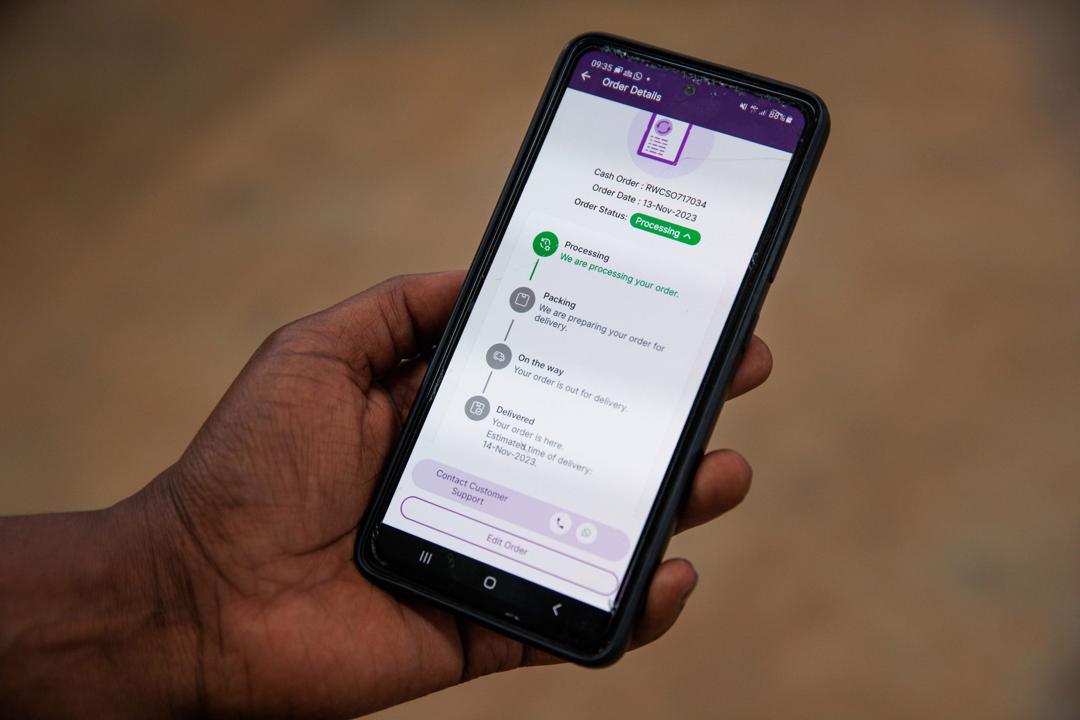

While e-commerce in Africa remains a small segment of retail compared to other regions, platforms like Wasoko have sought to streamline operations and drive profitability amidst market challenges.

As Wasoko navigates its merger with MaxAB, both companies aim to strengthen their position in the African B2B e-commerce space, leveraging their combined expertise and resources to lead the industry profitably.