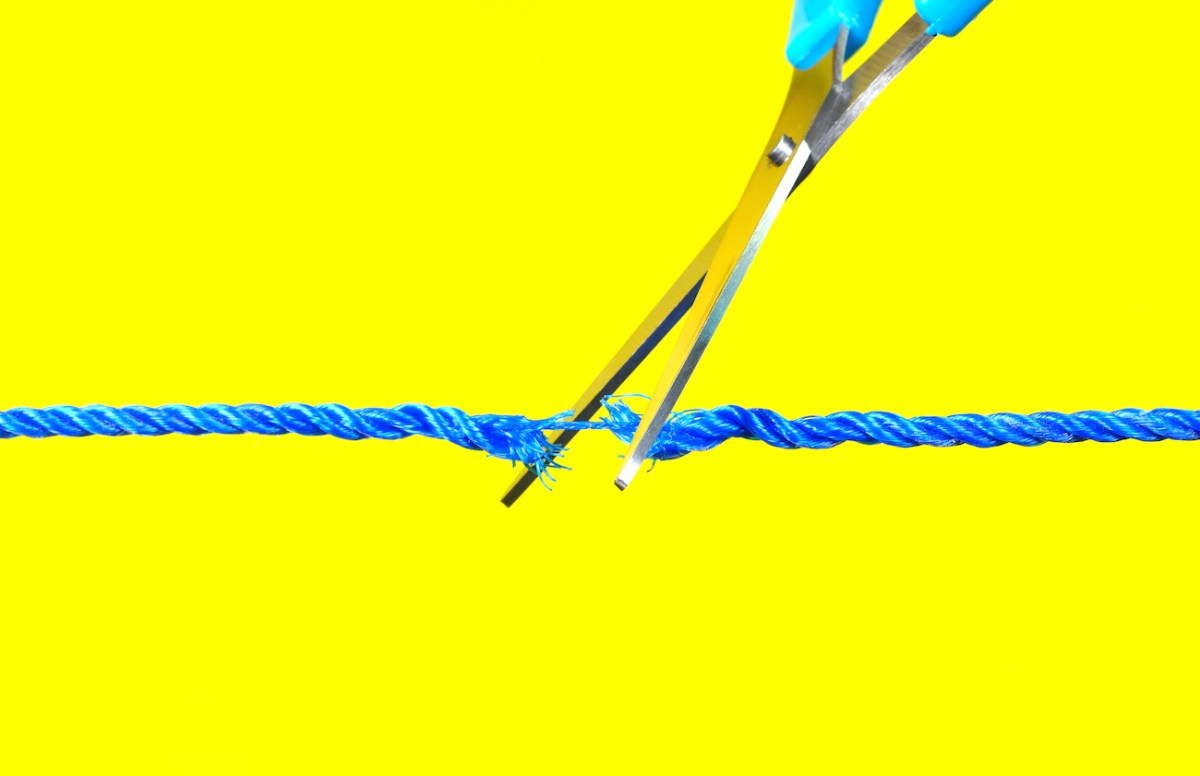

Banking-as-a-service startup (BaaS) Synctera has recently undergone a restructuring resulting in a staff reduction, as confirmed by the company to TechCrunch.

According to a report in Fintech Business Weekly, approximately 17 employees, or around 15% of the company, were affected by the cuts. Prior to the restructuring, Synctera had around 113 employees, and now has around 96.

Synctera specializes in a platform that connects fintech companies with sponsor banks. The company recently announced an extension round of $18.6 million on top of its initial $15 million Series A funding, which was disclosed in March of 2023. Additionally, they welcomed Leigh Gross as the new Chief Revenue Officer and added BTG Pactual and Flutterwave as customers.

Key investors in Synctera include NAventures, Lightspeed Venture Partners, Fin Capital, Banco Popular, and Mana Ventures.

When asked about the staff reductions, a company spokesperson stated: “Synctera has implemented a restructuring that led to a reduction in staff, and we are focused on supporting those affected. We remain committed to our current business line and are exploring new SaaS offerings for banks and companies.”

Synctera is not the only BaaS company that has recently downsized staff to conserve cash. Other BaaS companies like Treasury Prime and Synapse also resorted to layoffs in similar situations.

In the challenging landscape of BaaS, startups are facing regulatory scrutiny and may need to make tough decisions like layoffs to stay afloat.

For more updates on fintech news, subscribe to TechCrunch Fintech here.

Questions or tips? Reach out to us at maryann@techcrunch.com or via Signal at 408.204.3036. Secure communication options are also available here.