The U.S. Department of Justice filed a lawsuit against Apple on Thursday, accusing CEO Tim Cook’s company of engaging in anti-competitive business practices. Among the allegations are claims that Apple restricts competitors from accessing certain iPhone features and affects the “flow of speech” through its streaming service, Apple TV+.

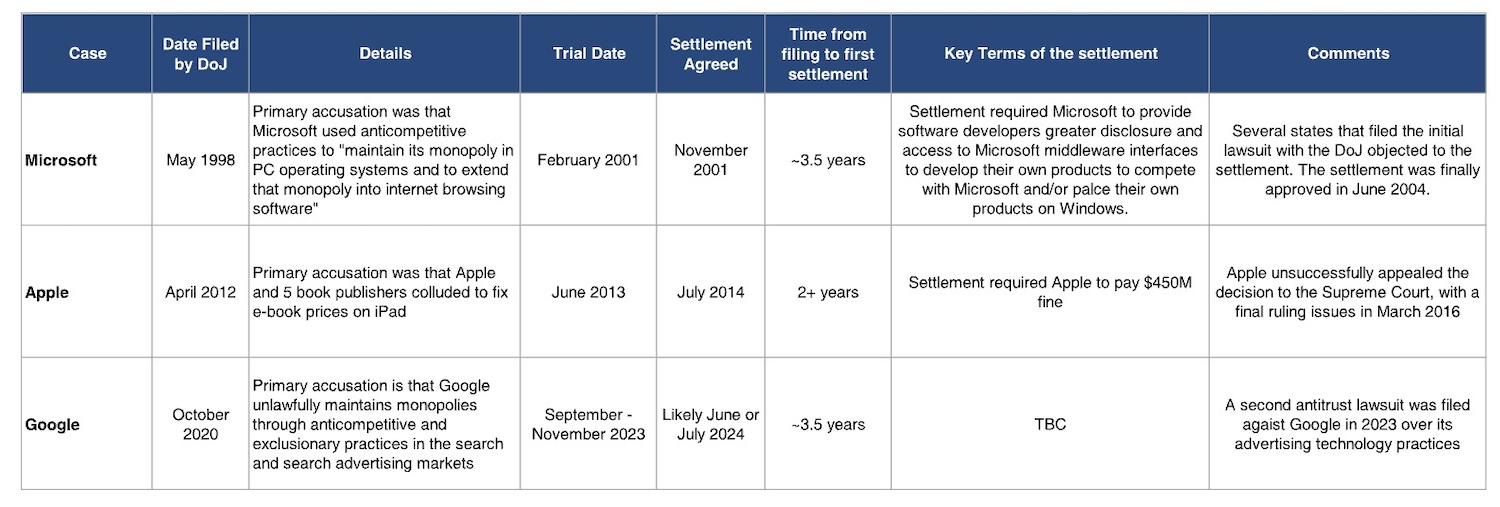

However, even if the DOJ proves any of the allegations, it is unlikely that Apple will face significant changes for years, as legal proceedings like these tend to take a long time to reach trial and resolution. For example, the DOJ’s case against Google, filed in 2020, only went to trial in 2023, with potential remedies or financial implications not expected for another few years.

This is not the first time Apple has faced legal action from the DOJ. Back in 2012, the agency sued Apple for colluding with publishers to raise ebook prices, a lawsuit that wasn’t resolved until 2016.

“Past cases indicate that resolving such complaints can take three to five years, including appeals,” noted Bernstein analysts in a recent report.

Regarding the current lawsuit, Morgan Stanley analysts mentioned that it might actually work in Apple’s favor. Many similar allegations were already addressed in the Apple vs Epic case, with a ruling stating that Apple did not violate antitrust laws. Additionally, the DOJ lawsuit briefly mentions Apple’s large search deal with Google, and does not specifically cite the App Store as a primary example of monopolistic behavior.

Previous major antitrust cases. (Image: Bernstein)

Bernstein analysts added, “While the DoJ’s charges are focused on iPhone, we do not see likely remediation as materially impacting Apple financially or undermining the iPhone franchise: worst case, Apple pays a fine, and loosens restrictions for competition across the iOS platform, which we believe will have limited impact on iPhone user retention or on Services revenues.”

This led Morgan Stanley analysts to conclude that the DOJ’s lawsuit poses more of a headline risk than an immediate threat to Apple’s operations.

They stated:

In other words, while this lawsuit could impact Apple’s stock short-term, historical precedents show that company fundamentals are likely to drive its stock price over the next 12 months and beyond, rather than this litigation. We have seen cases where companies in legal battles over their core products have outperformed, despite the legal challenges. For example, Apple’s stock performed well following the Apple/Epic case and Google’s stock nearly doubled post-DOJ investigation into Alphabet’s search practices. Regulation and litigation may pose long-term risks, but for now, Apple’s stock is more likely to be influenced by its underlying business performance than ongoing legal proceedings.