Apple has been steadily expanding its financial services in recent years, edging closer to becoming a full-fledged bank. With features like Apple Pay, Apple Cash, the Apple Card, and more recently, the Apple Card Savings Account and Apple Pay Later service, the line between your bank account and your iPhone is becoming increasingly blurred. This integration is particularly beneficial for those who are deeply entrenched in Apple’s ecosystem.

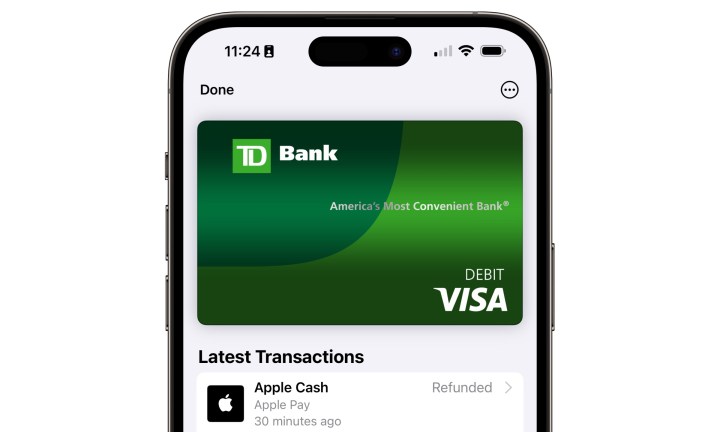

Among Apple’s iPhone-integrated financial features, Apple Cash stands out as one of the most useful. Formerly known as “Apple Pay Cash,” the service allows users to easily send and receive money via Apple’s Messages app. Moreover, with Apple Pay integration, Apple Cash users also get a virtual debit card that enables them to make purchases at any retailer accepting Visa Debit.

While Apple Cash is not backed by a traditional bank, it is supported by Green Dot Bank behind the scenes, ensuring that users’ money is FDIC-insured. Additionally, Apple Cash serves as the repository for Daily Cash rewards for Apple Card holders.

What You Need to Use Apple Cash

To use Apple Cash, you need a compatible device running the latest iOS, iPadOS, watchOS, or visionOS. Additionally, you must be at least 18 years old, reside in the U.S., and have two-factor authentication enabled on your Apple ID. You also need a valid U.S. address and an eligible debit card for funding.