A few years ago, payments orchestration was unfamiliar to many large companies Juan Pablo Ortega spoke with. Today, the Yuno co-founder and CEO finds that the landscape has significantly shifted.

“The perception has changed dramatically,” Ortega shared with TechCrunch. “Many large companies now understand what payment orchestration is, and some are even requesting proposals solely for orchestration.”

These multinational companies often use multiple payment providers, acquirers, and banks globally, but Yuno argues that they only need one global payments orchestration provider. Payments orchestration integrates all these payment entities into a single layer, streamlining payment conversion processes. Yuno’s product, launched in October 2022, offers over 300 payment methods, fraud detection, one-click checkout, and smart routing technology.

TechCrunch previously covered the Colombian payments startup when it raised $10 million from prominent investors like Andreessen Horowitz. Yuno has now facilitated transactions in over 40 countries for enterprise clients such as McDonald’s, Rappi, Avianca, and inDrive.

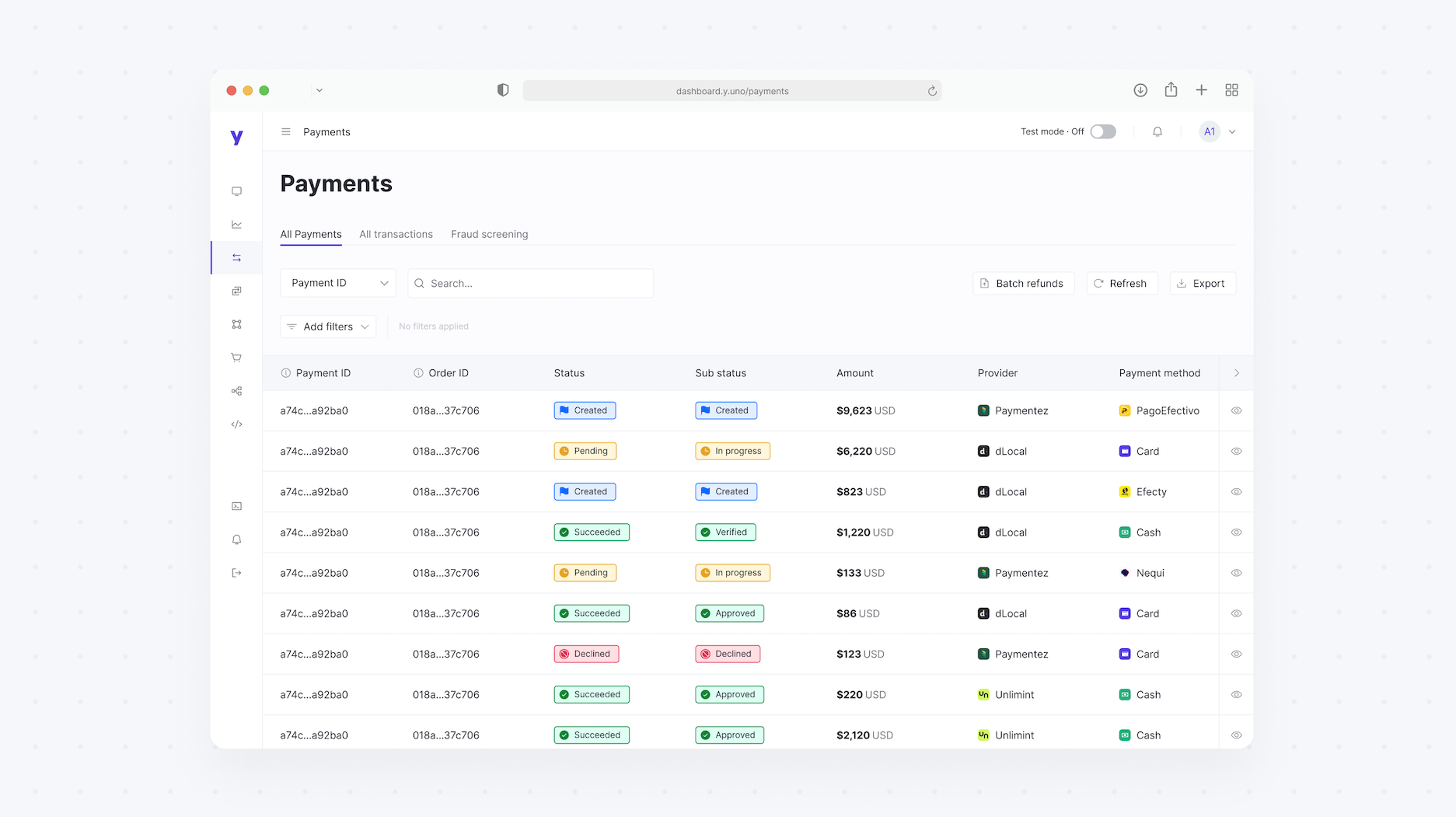

Yuno’s payments dashboard. (Image credit: Yuno)

The global payments orchestration market is projected to surpass nearly $7 billion by 2032. In Latin America, merchants expanding internationally must navigate collecting different currencies and catering to customers without credit cards.

This opportunity has attracted companies worldwide aiming to tap into this market, including Gr4vy, Plug, and Revio. Following Yuno’s success in securing top-tier investors, Simetrik, also based in Colombia, is developing a payment infrastructure with backing from Goldman Sachs.

While many competitors focus on SMBs, Yuno stands out by specializing in large enterprise solutions. Ortega emphasizes, “We are one of the few orchestrators with global integrations, boasting over 150 connections enabling access to payment methods across continents.”

Last year, Yuno attracted attention from DST Global Partners, leading to a $25 million Series A funding round. Investors like DST, Andreessen Horowitz, Tiger Global, Kaszek Ventures, and Monashees have collectively valued Yuno at $150 million.

The funds will be utilized to strengthen Yuno’s presence in Asia, Europe, and Africa, as well as to enhance its payment orchestration platform.

“We will continue expanding our sales, product, and tech teams in the first quarter,” Ortega explained. “With offices in Latin America, New York, and Singapore, further establishing our presence in these markets will be crucial for the year ahead.”