The merger of Indian media assets of Reliance, its portfolio Viacom18 and Disney will create an entity that captures 85% of the country’s on-demand streaming service audience and about half of the TV viewers, analysts said, posing bigger challenges to Netflix, Amazon’s Prime Video, Apple, Sony and Zee.

The merger, expected to be finalized by March of 2025, will give exclusive digital and broadcast rights to key sporting events, including the next four years of popular cricket tournament IPL, flagship ICC events, domestic Indian cricket, FIFA World Cup, Premier League, and Wimbledon.

Streaming cricket matches have been a major draw for new users on streaming platforms in India. By securing various cricket rights, Disney and JioCinema have limited content options for competing services to attract fans.

“The combined new entity now holds both digital and TV rights for major cricket events in India, such as IPL and ICC matches,” Morgan Stanley analysts wrote in a note on Thursday.

“The 2023-27 IPL broadcasting rights are now under the JV – Viacom 18 has digital streaming rights (acquired for US$2.9bn) while Star has TV broadcasting rights for US$2.8bn. In the IPL 2023 season, JioCinema streamed matches for free to all users, impacting Hotstar’s profits. However, with the JV structure, we could see significantly improved profitability.”

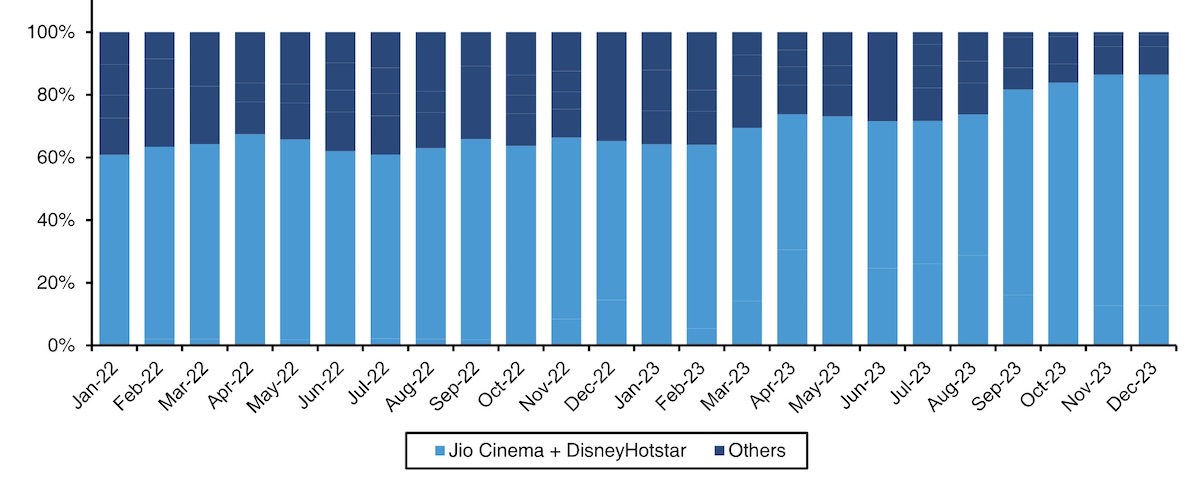

Data and image: Bernstein

The merged entity will also have exclusive access in India to Disney’s movies and productions, as well as the company’s vast catalog of 30,000 content, becoming the digital hub for content from HBO, Warner Bros, Showtime, and NBCUniversal.

Bernstein analysts estimated that the combined operations of Disney’s Hotstar and JioCinema will lead the Indian OTT market with approximately 85% of the monthly active OTT user base.

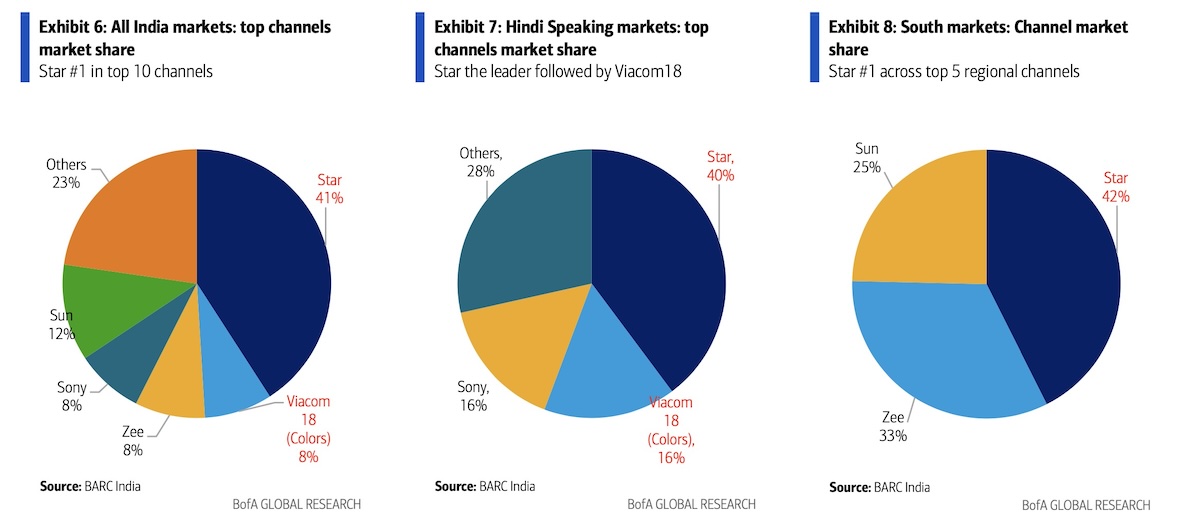

Data, image: BofA

Star, a part of Disney’s India portfolio, holds 41% of the broadcast market share in India. Along with the approximately 8% of the TV market share that Viacom18 brings in, the combined operations – with over 100 TV channels – will dominate about 49% of the broadcasting market.

According to analysis by Bank of America analysts, the two companies will have 56% of the Hindi-speaking TV audience in the country.