LiftOff’s Vice President of Global Sales, Joey Fulcher, delves into the findings of the company’s recent survey to uncover why App Marketers remain optimistic about the future despite facing market challenges.

In today’s mobile gaming landscape, countless games vye for attention in an industry that is becoming increasingly saturated. Even games with renowned global IPs can struggle to find success in the mobile market, as seen with examples like Apex Legends Mobile, The Walking Dead: Betrayal, and Full Metal Alchemist Mobile. Research indicates that a staggering 83 percent of mobile games fail within three years of launch.

Amid a landscape where game developers face evolving privacy regulations that impact profitability, mobile game marketers are tasked with driving user acquisition (UA) and revenue growth despite these obstacles. This begs the question: how are app marketers navigating these challenges?

To shed light on this, we conducted the 2024 App Marketer Survey, surveying over 500 mobile marketers with monthly ad budgets ranging from $50,000 to over $1,000,000 across various regions and app verticals. The survey revealed that most app marketers are pursuing ambitious key performance indicator (KPI) targets, boosting budgets, increasing resources, and maintaining a positive outlook for the future.

Although the full report covers insights from both non-gaming and gaming app marketers, we specifically highlight how game marketers responded to the survey to help other marketers better understand industry shifts and optimize their ad spend.

Return on Ad Spend Takes Center Stage for Game Marketers

For many game marketers, the primary metric of focus remains return on ad spend (ROAS). 53 percent of gaming respondents identified ROAS as their top priority, followed by cost per install (CPI) at 23 percent and lifetime value (LTV) at 13 percent. In contrast, 31 percent of non-gaming respondents prioritized ROAS, indicating a significant disparity. Additionally, cost per action (CPA) emerged as the second-highest focus for non-gaming marketers at 27 percent.

Percentage of Gaming Respondents Prioritizing KPIs:

The divergent priorities between gaming and non-gaming advertisers are understandable. Game developers aim not only to attract new users but also to implement intricate LiveOps strategies to ensure sustained user engagement.

While understanding the initial acquisition cost of a user remains essential, grasping the revenue generated over time serves as a more accurate indicator of campaign efficacy for gaming marketers. In contrast, non-gaming app verticals, such as dating and fitness, rely heavily on initial install metrics due to high churn rates.

To enhance ROAS, gaming marketers can focus on cost-effective ad formats. While playable ads attract marketers due to their low CPI, they yield the lowest return on ad spend. Our 2023 Mobile Ad Creative Index analysis revealed that native and banner ads outperform playables, registering D7 ROAS rates of 18 percent and 17 percent, respectively, with playables at 12 percent.

Quality User Access Is Vital for Demand-Side Platforms

Demand-side platforms (DSPs) play a crucial role for mobile marketers by offering technologies that enhance ad campaign performance through cross-device targeting, creative optimization, and audience segmentation. For gaming advertisers, top DSPs provide improved access to high-quality users—those most likely to convert into paying customers.

The majority of our survey respondents agreed with this perspective, as 58 percent of marketers from gaming and non-gaming apps cited access to “quality users” as their top DSP selection criterion. This marked a 40 percent increase over those prioritizing campaign scalability.

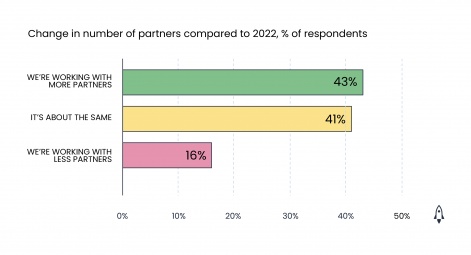

As 43 percent of gaming respondents indicated they are collaborating with more partners, selecting a DSP that aligns with your goals becomes crucial. An ideal DSP should offer scalability while focusing on expanding the base of high-quality users. For instance, Liftoff Accelerate enables reaching over three billion unique users across 190+ countries with advanced machine learning models tailored to target high-value app users.

Media Mix Modelling Influences Ad Spend Allocation

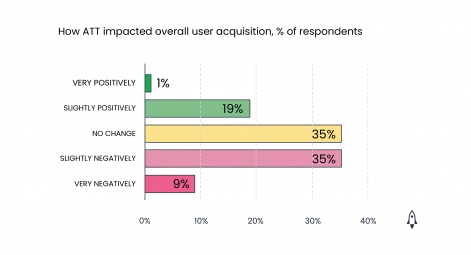

Nearly two years since Apple implemented its privacy framework, App Tracking Transparency (ATT), many mobile marketers still grapple with its impact on UA. 44 percent of gaming marketers in the survey indicated that ATT had a negative effect on user acquisition in 2023, with 41 percent reducing spending on iOS campaigns as a result.

The diminishing availability of granular data through media mix modelling (MMM) poses a challenge for mobile marketers. MMM assesses the impact of marketing initiatives in achieving specific goals by considering various internal and external factors. Almost half of the survey respondents had adopted MMM, with 10 percent using it exclusively and 39 percent combining it with a mobile measurement partner’s (MMP) attribution model. Of those leveraging media mix modelling, 61 percent adjusted their ad spend based on the data.

Google’s GAID Changes Pose Challenges for Marketers

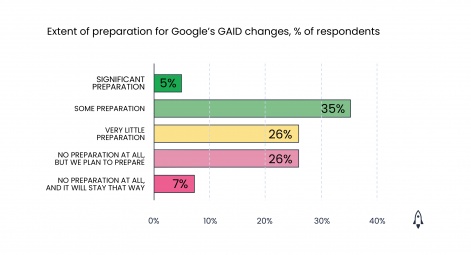

Looking ahead, Google is set to deprecate GAID (Google Advertising ID) in 2024, adding to the privacy changes that marketers must navigate. Surprisingly, a significant portion of the gaming respondents admitted to being underprepared for Google’s GAID changes. While some had done minimal preparation, others had not made any preparations at all. Despite this, many respondents displayed some understanding of the impending changes, though a notable percentage remained unfamiliar.

Marketers stand to benefit from taking advantage of the advance notice provided by Google regarding the GAID changes. Understanding these changes and their impact on campaign measurement is crucial for optimizing strategies and adapting to the evolving landscape effectively.

Similarly, a concerning number of gaming survey respondents (34 percent) reported unfamiliarity with Apple’s SKAN 4 changes, despite its launch over a year ago. Embracing SKAN 4 can offer advertisers valuable insights by providing up to three postbacks with different activity windows, enabling a better understanding of user engagement up to 35 days post-install.

Optimism Prevails in Games Marketing

Despite the challenges faced by the gaming industry, there are numerous opportunities for proactive developers. Privacy regulations are reshaping the UA terrain, and industry layoffs are on the rise. Nevertheless, game marketers maintain a cautiously optimistic outlook, with 52 percent anticipating improvements in the next 12 months.

The slightly more generous budgets expected this year help alleviate the pressure of meeting heightened targets. Nearly half of gaming marketers foresee a budget increase in 2024, with an additional 18 percent anticipating a significant rise. Resource allocations are also set to expand, particularly in organic social/viral, influencer, and community-building areas.

To leverage market opportunities and maximize available resources, game marketers should collaborate with trusted ad partners to achieve their goals in the upcoming year.